Our therapeutic areas

Cantargia’s market focus

Since IL1RAP is present on a large number of solid tumors, there is potential to utilize Cantargia’s platform for treatment of several forms of cancer. Cantargia is focusing on the development of its leading candidate nadunolimab on pancreatic ductal adenocarcinoma (PDAC) whilst exploring opportunities in non-small cell lung cancer. In addition to oncology, the interleukin 1 (IL-1) super family has been shown to be involved in several autoimmune and inflammatory diseases. Cantargia has developed the CAN10 antibody, acquired by Otsuka Pharmaceutical, and recently announced new bispecific anti-IL1RAP projects within the immunology space.

Market Potential for nadunolimab

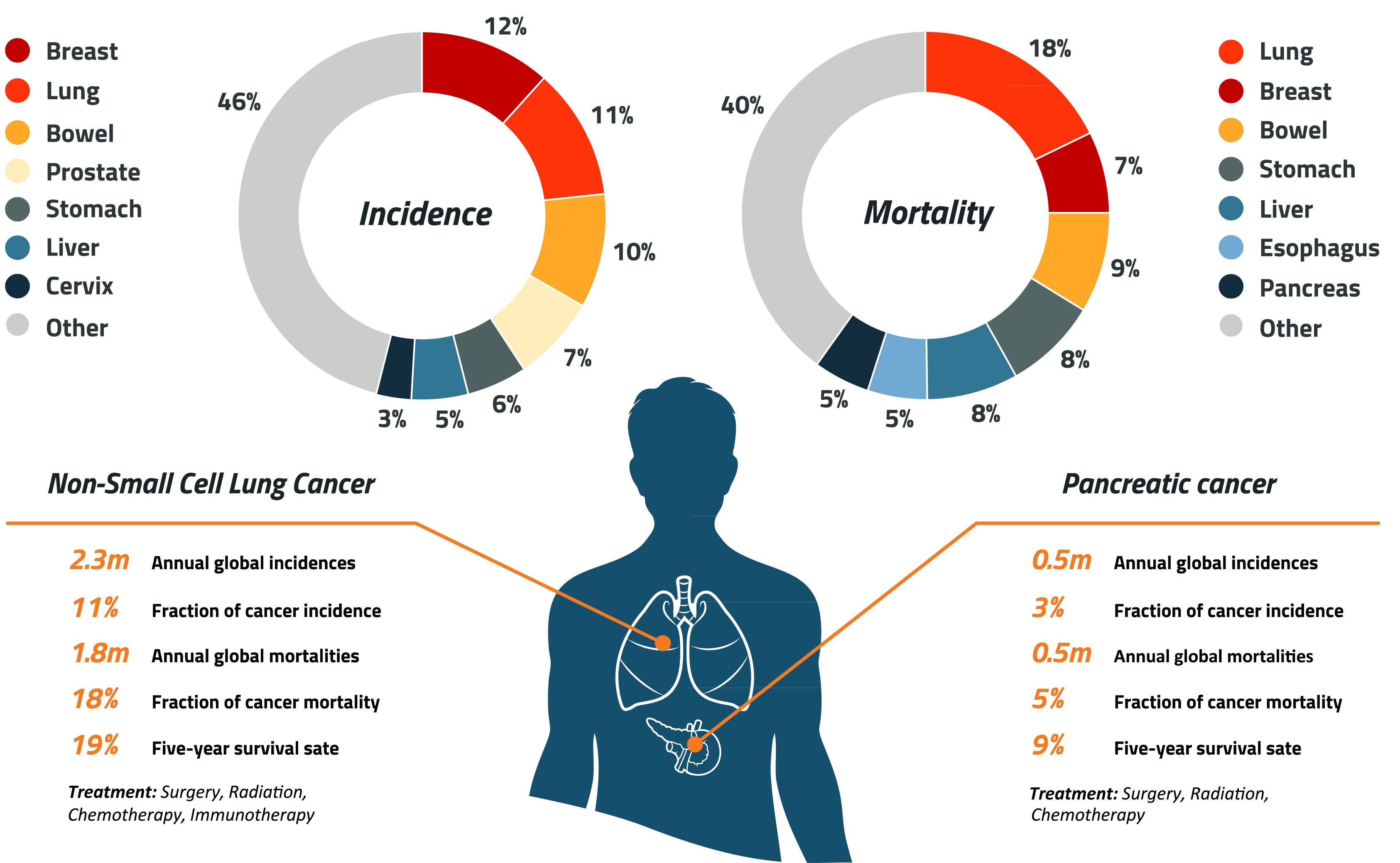

Pancreatic cancer is the 3rd leading cause of cancer-related deaths in developed countries including US and Europe. The number of patients newly diagnosed with pancreatic cancer in 2024 was approximately 230.000 in the 8 major global market1. In 61% of these patients the disease had developed in an advanced or metastatic stage2. Based on IL1-RAP expression, approximately 85.000 patients are eligible for first line PDAC treatment with Nadunolimab. The majority of patients treated for PDAC receive first line chemotherapy in various combinations. Over the last decade the incidence of pancreatic cancer has increased, largely due to the increasing prevalence of obesity and an aging population. Where the 5-Year relative survival rate (2015-2021) in all cancer types is ca. 69%, in PDAC the 5-Year relative survival rate is only 13%3.

Non-small cell lung cancer (NSCLC) is the 2nd most common cancer in the world and the leading cause of cancer mortality in men and women. Of the total lung cancer incident cases, approximately 85% of patients are impacted by the NSCLC subtype. Although NSCLC patients are diagnosed in the later stages of the disease, which often leads to poor prognosis, 5-Year relative survival rate has improved from 16% in 2000 to 30% in 20174, with a continued positive trend in 2021.

Excellent Commercial Potential for CAN10

Inflammatory diseases are conditions where the body’s immune system reacts to an injury or attack by triggering inflammation. Inflammation is part of the body’s natural defense mechanism and can be activated by infections, injuries, or autoimmune reactions. Inflammation is usually resolved, but when it becomes chronic it can lead to serious tissue and organ damage. Autoimmune diseases occur as the immune system accidentally attacks healthy cells instead of protecting these. The treatment of inflammatory diseases often aims at reducing inflammation and relieving symptoms. By blocking IL1RAP, CAN10 creates many opportunities to influence conditions within the inflammation and immunology field, an area that has grown enormously over the past years. More than half of all diseases are considered to have an inflammatory or immunological component, and drugs in immunology that address a fundamental physiological cause of autoimmunity, such as CAN10, can therefore be applied to many diseases. Immunology, the second largest therapeutic area worldwide after oncology, had a market size of USD 194 billion in 20245 and is divided into treatment of autoimmune and inflammatory diseases. The autoimmune disease market amounted to USD 165 billion in 2024 and is expected to grow by around 4% annually through 2029. Therapeutics for the treatment of inflammatory diseases reached a market size of USD 29 billion in 2024, which is expected to grow by around 14% annually until 2029.

Market for Bispecific Antibody Therapies and ADCs

The bispecific antibody market is experiencing rapid expansion, driven by growing adoption in both oncology and inflammatory diseases. These market dynamics reflect a significant shift toward bispecific antibodies as key components of future treatment paradigms, with their dual-targeting capability offering potential advantages in efficacy, safety, and convenience over existing therapeutic approaches. The bispecific antibody market is projected to expand by approximately USD 30 billion by 2030, making it a major contributor to the overall growth of the antibody market. In parallel, the ADC market continues to demonstrate strong commercial and scientific momentum. The growing industry interest in IL1RAP reflects the broader expansion of this segment, driven by ongoing innovation and increasing clinical success. Key growth drivers of the ADC market include the high adaptation rate of ADC drugs in breast cancer, the dominating segment of ADC drug sales, the present and future (indication expanding) sales of ADC blockbusters such as Enhertu (Daiichi Sankyo/AstraZeneca), Kadcyla (Roche), and Trodelvy (Gilead) as well as general ADC pipeline expansion, supported by the increasing interest in strategic investments by large pharmaceutical companies. Whereas the global antibody market is expected to grow by USD 200 billion by 2030, driven by both new approvals (36 FDA approvals over the last 3 years) and expanded indications, approximately 10% (or USD 20 billion between 2025 and 2030) of this growth will come from the expansion of the ADC segment, reflecting its increasing role in oncology and other high-value therapeutic areas.

[1] US, EU-4, UK, China, Japan, Global Data, 2025

[1] Stage III unresectable/Stage IV (excluding patients progressing from earlier stages)

[1] SEER data on 5-Year Relative Survival Rates, 2015-2021, all stages

[1] SEER data on 5-Year Relative Survival Rates, 1975-2021, all stages

[1] Immunology at an inflection point: Opportunities & challenges for innovators seeking growth in an unforgiving market (IQVIA 2025)